Under the periodic system, an Inventory account exists but is inactive until its balance is updated to the correct inventory balance at year-end. Also open accounts receivable subsidiary ledger accounts for Brooke Sledd, Paul Kohr, and Amy Nilson. Open the general ledger accounts with balances as shown in the previous problem (do not open a Cost of Goods Sold ledger account).

Journalize the April transactions shown in the previous problem that should be recorded in the sales journal and the cash receipts journal assuming the periodic inventory system is used.Ģ. Prepare headings for a cash receipts journal like the one in Exhibit 7A.2. Prepare headings for a sales journal like the one in Exhibit 7A.1. in the previous problem uses the periodic inventory system.ġ.

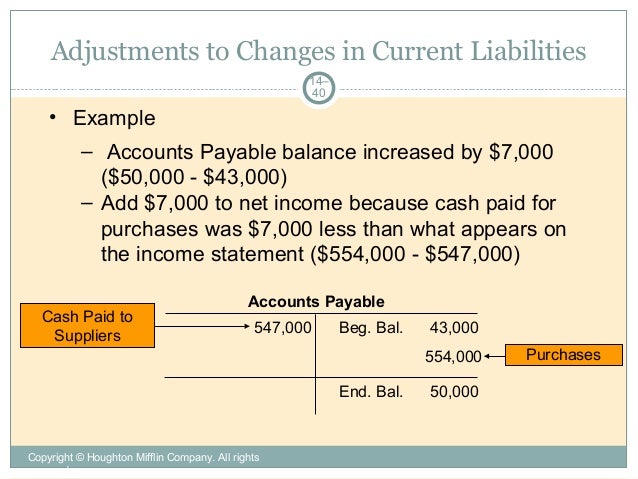

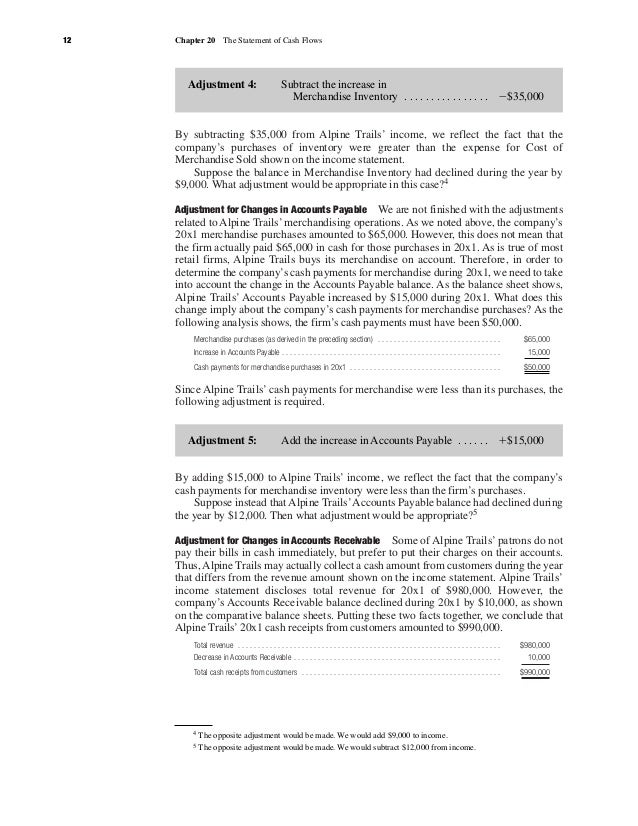

Instead, only the reconciliation of net income to net operating activities, as described above, is reported. As discussed in ASC 230-10-45-25 and ASC 230-10-45-28, when the indirect method is used, a reporting entity does not report the gross cash receipts and gross payments required by the direct method.All items included in net income that do not affect operating cash receipts and payments (for example, all items for which cash effects are related to investing or financing activities (e.g., depreciation, amortization, gains or losses on dispositions of long-lived assets, and foreign currency gains and losses from the retirement of foreign denominated debt)).All deferrals of past operating cash receipts and payments, and all accruals of expected future operating cash receipts and payments (for example, changes during the period in receivables and payables pertaining to operating activities).The reconciliation removes the effects of the following: Net income, including earnings attributable to the controlling and noncontrolling interests, is the starting point to reconcile cash flows from operating activities.

To illustrate how operating cash flows (prepared on the cash basis of accounting) relate to net income (prepared on the accrual method of accounting), as discussed in ASC 230-10-45-28, the direct method also requires a reconciliation of net income to net cash flows from operating activities. Transfers and servicing of financial assets Revenue from contracts with customers (ASC 606) Loans and investments (post ASU 2016-13 and ASC 326) Investments in debt and equity securities (pre ASU 2016-13) Insurance contracts for insurance entities (pre ASU 2018-12) Insurance contracts for insurance entities (post ASU 2018-12) IFRS and US GAAP: Similarities and differences

Business combinations and noncontrolling interestsĮquity method investments and joint ventures

0 kommentar(er)

0 kommentar(er)